Managing cash flow well is one of the most important elements in running a successful business. Many businesses, especially small and medium-sized ones, often face problems maintaining positive cash flow due to poor financial management. Healthy cash flow ensures that a business can meet its financial obligations on time, invest in growth, and survive uncertain economic situations.

In the current technological era, technology is very useful for helping companies optimize their financial management. Odoo is an integrated business management platform that offers various modules to support business operations, such as financial management and accounting. Companies can improve the efficiency, accuracy, and transparency of their financial processes with its advanced features.

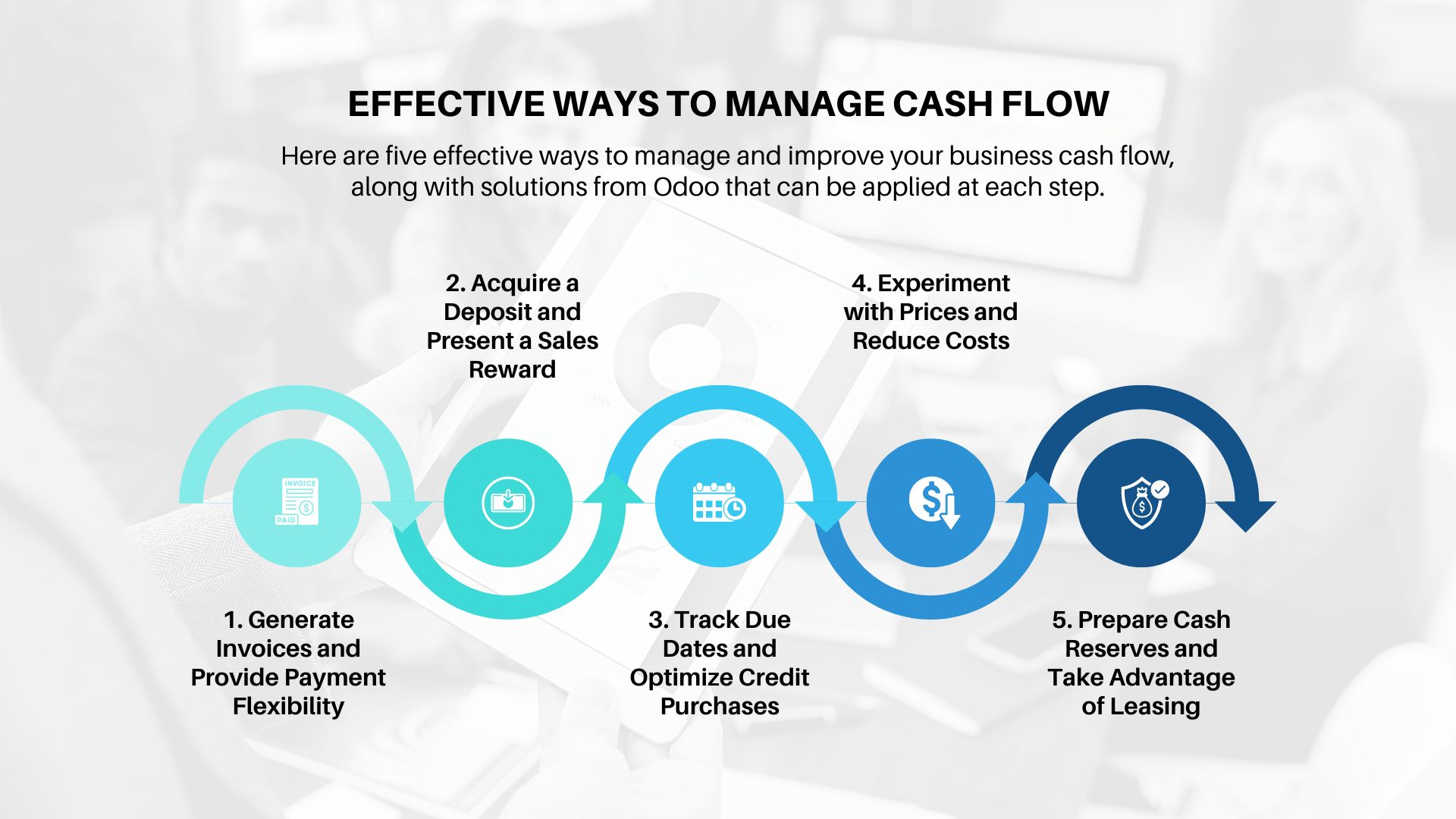

In this article, you will discover five effective ways to manage and improve your business cash flow by combining Odoo solutions. Each point will be explained in depth, and you will have examples to apply practically. By following these guidelines, your business can see growth opportunities and gain financial stability.

Also Read: Organize your business finances more efficiently using the Odoo Expenses Module

1. Generate Invoices and Provide Payment Flexibility

Sending invoices as quickly as possible after work is completed or products are shipped is critical to ensuring steady cash flow. Delays in sending invoices can lead to payment delays, ultimately disrupting business liquidity. Using Odoo, you can automate the creation and sending of invoices. Odoo allows you to set automatic reminders to send invoices as soon as a transaction is completed.

Additionally, Odoo provides features to offer customers various payment options, such as credit cards, bank transfers, or even electronic payment methods such as PayPal. This flexibility not only makes it easier for customers to make payments but also speeds up the cash receipt process because customers have more ways to fulfill their obligations.

Example: A company selling digital products can set Odoo to send invoices automatically when the product is sent via email. Customers can pay directly via the link provided on the invoice with their preferred payment method, speeding up cash receipts.

2. Acquire a Deposit and Present a Sales Reward

Getting deposits from customers, especially for large orders, is an effective way to ensure funds are coming in before work begins or products are shipped. This reduces liquidity risks and helps in cash flow management. Odoo makes it easy to manage deposits through a sales module that can organize and track these initial payments, as well as associate them with related orders or projects.

On the other hand, offering sales incentives such as discounts or special promotions can help increase overall sales, ultimately increasing cash flow. Odoo allows you to create and track promotional campaigns effectively, providing real-time analytics to assess promotional success and any adjustments that may be necessary.

Example: A construction company may require a 30% deposit before starting a large project. This deposit is recorded in Odoo and used to fund the initial purchase of materials. Additionally, they can offer a 5% discount on the initial payment of the entire project, which is managed and monitored through the Odoo system.

3. Track Due Dates and Optimize Credit Purchases

Tracking invoice due dates and forecasting sales are two important aspects of cash flow management. With Odoo, you can set reminders for invoice due dates, reducing the chances of late payments from customers. Odoo's financial reporting feature also allows you to forecast sales based on historical data, providing better insight into when money will come in and out of the business.

Optimizing purchases on credit terms is also a very important strategy. By purchasing goods or raw materials using credit, you can delay cash outlays, thereby providing more time for cash inflow from sales. Odoo has a purchase management feature that allows you to track debts to suppliers and arrange payments according to credit maturity so that cash remains available for other urgent needs.

Example: A retail company uses Odoo to track invoice due dates and forecast monthly sales. They also purchase stock on 30-day credit terms, which is recorded in Odoo. This way, they can delay payments to suppliers until they receive payment from customers, keeping cash flow healthy.

4. Experiment with Prices and Reduce Costs

Optimizing pricing strategies can be an effective way to increase revenue and cash flow. Using the sales module in Odoo, you can conduct various pricing experiments and analyze their impact in real time. Odoo also allows you to segment customers and set custom prices based on those segments, increasing profit margins and attracting more customers.

Reducing operational costs is another way to keep cash flow positive. Odoo provides various features to optimize business processes, such as reducing overhead costs by automating administrative tasks, managing inventory more efficiently, and reducing production waste. The cost analysis provided by Odoo helps you identify areas that need improvement, thereby reducing unnecessary expenses.

Example: A manufacturing company uses Odoo to experiment with different product prices in different markets. They also leverage Odoo features to reduce operational costs by automating inventory management, thereby reducing storage costs and stock loss.

5. Prepare Cash Reserves and Take Advantage of Leasing

Having emergency cash reserves is critical to maintaining business continuity when unexpected disruptions occur, such as a decline in sales or a sudden increase in operational costs. By using Odoo, you can monitor cash conditions in real time and manage allocations for reserve funds. Odoo also allows you to plan and project future cash needs, so that cash reserves can be better prepared.

Taking advantage of leasing or “rent now buy later” options is another way to manage cash flow. With leasing, you can reduce initial expenses for purchasing equipment or large assets, and pay for them periodically according to incoming cash flow. Odoo can help you track leasing payments and manage your budget to ensure they don't disrupt daily cash flow.

Example: A technology company uses Odoo to allocate a portion of its monthly revenue into emergency cash reserves. Additionally, they use leasing to purchase new IT equipment, the payments for which are managed and tracked through Odoo to ensure cash flow remains stable.

Conclusion

Managing and improving a business's cash flow is an important aspect that influences a company's financial stability and ability to grow. By adopting strategies such as sending invoices quickly, obtaining deposits for large orders, offering flexible payment options, tracking due dates, and experimenting with pricing and cost reductions, companies can keep cash flow healthy. Implementing technology, such as using Odoo, further strengthens the effectiveness of these strategies with automation and integrated management, so that companies can focus more on business development.

Apart from that, preparing emergency cash reserves and utilizing leasing for large asset purchases are also important steps in maintaining stable cash flow. By optimizing the use of Odoo, companies can plan and project financial needs more accurately, ensuring that every step taken is based on strong data. By implementing this strategy, businesses can not only overcome cash flow challenges but also open up opportunities for sustainable and more scalable growth.