PPh 21 is a monthly income tax deduction for employees in Indonesia. Companies are responsible for calculating and withholding this tax, which requires accuracy and ease of management. This article discusses Addons, an extension that helps companies manage employee PPh 21 effectively and accurately.

Addons are equipped with various features that facilitate PPh 21 calculation and management. With Addons, companies can categorize employee data based on Exclusive Rates and Restitution (TER), choose the appropriate tax calculation method, and automatically and accurately calculate employee gross income and PPh 21. Additionally, Addons allow companies to monitor and manage employee marital status and Taxpayer Identification Number (NPWP) information, calculate annual income value, and easily set up salary rules related to taxes.

PPh 21? Done!

Managing employee PPh 21 matters has become easier and faster with the PPh 21 Tax Deduction Addons. With its advanced features, you can free yourself from complex and error-prone manual calculations.

Utilize the convenience and accuracy of this addon to ensure the tax compliance of your employees remains optimal.

Key Features of Addons

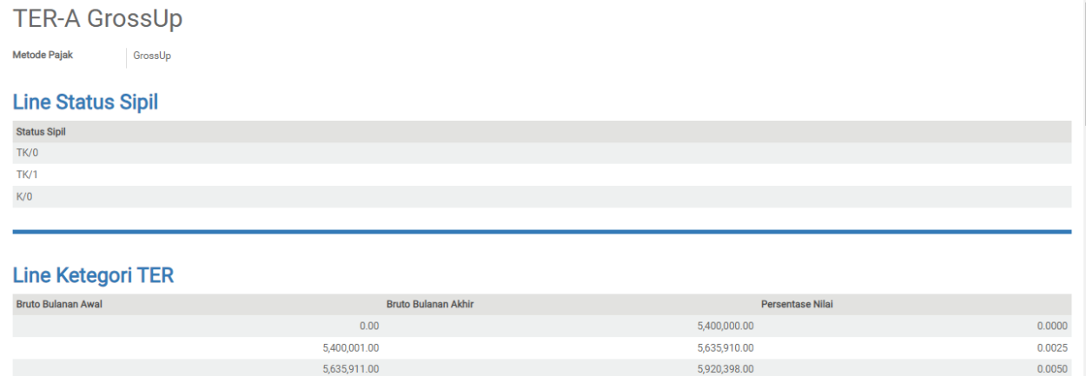

TER Category Master Data

This makes it easier for you to manage and categorize employee data based on Exclusive Rates and Restitution (TER).

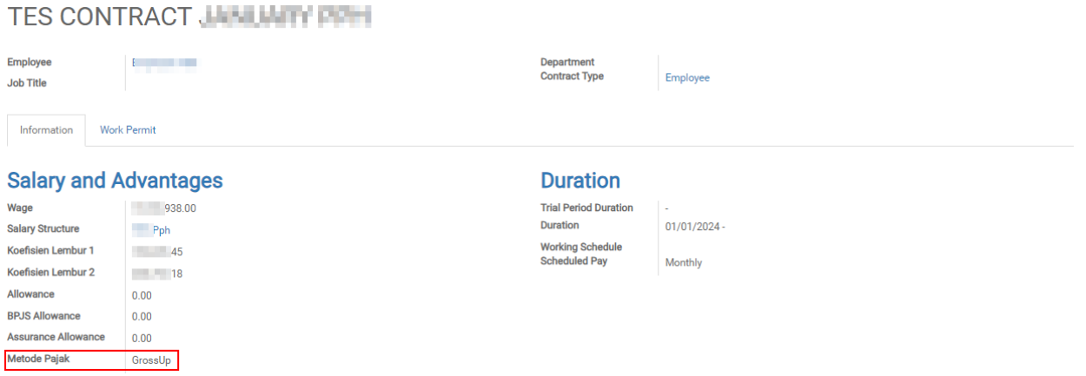

Tax Method Selection

Provides flexibility in determining the tax calculation method, including Gross and Gross-Up options.

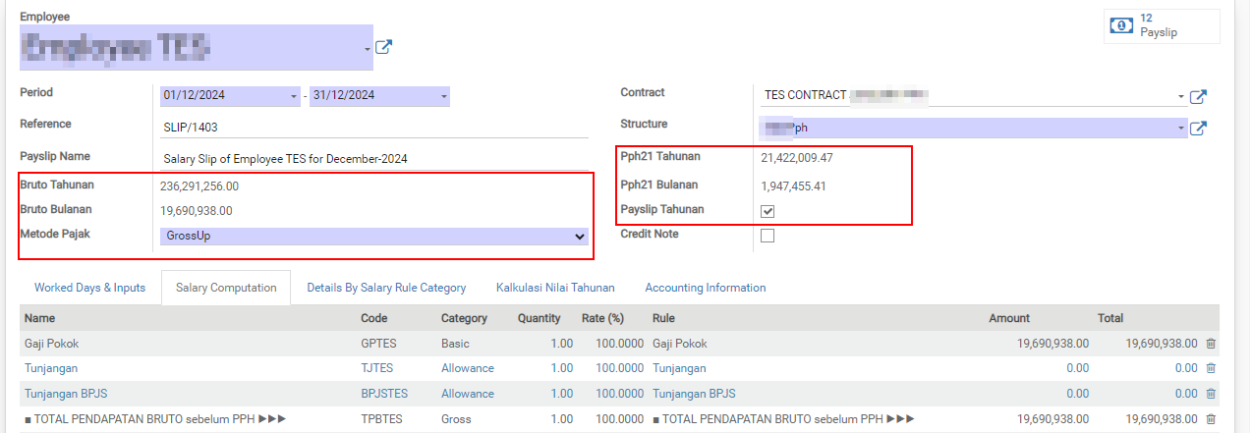

Gross Income Calculation

Facility to accurately calculate employee monthly and annual gross income.

Calculation of Pph 21

An efficient tool for calculating and deducting Pph 21 monthly and annually according to applicable regulations.

Salary Rules Tax Category

Provides Python code that can be easily integrated for setting salary rules related to taxes.

Civil Status and NPWP

Allows you to monitor and manage employee civil status information and Taxpayer Identification Number (NPWP) effectively.

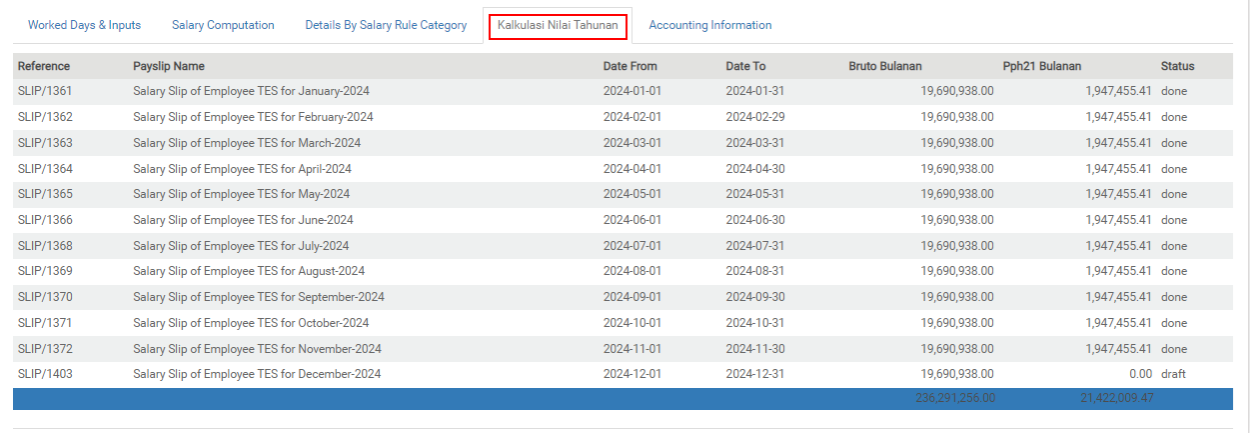

Annual Value Calculation

Facility to easily calculate and monitor the value of employee annual income.

Easy Use

A user-friendly interface with clear guidelines makes it easy for users to use and optimize the available features.

Available TER Master Data:

- Tax Method: Choice between Gross (Gross) and Gross-Up (Gross after tax).

- Civil Status: Selection of employee civil status for TER categories, such as single, married, divorced, and others.

- Adjustment of Lower Limit & Final Limit Values: Ease of adjusting limit values in tax calculations according to company needs.

- Percentage Value Conversion: To use percentage values, you can easily convert them by dividing them by 100 first.

Benefits of PPh 21 Tax Deduction Addons

Manage PPh 21 Accurately & Easily

The PPh 21 Tax Deduction Addons provide all the features you need to manage employee PPh 21 easily and precisely.

Reliable PPh 21 Solution for Your Business

Increase PPh 21 tax efficiency and compliance with PPH 21 Tax Deduction Addons—a trusted solution for your business.

Hassle-Free PPh 21 Tax Compliance

PPh 21 Tax Deduction Addons help you ensure compliance with PPh 21 tax regulations without hassle.

Save Time and Avoid Mistakes

PPh 21 Tax Deduction Addons help you calculate PPh 21 automatically and accurately. Save time and focus on other more important things.

Interface Display

Free yourself from the burden of PPh 21 and

focus on other more important things.

Use the PPH 21 Tax Dedaction Addons to manage employee PPh 21 easily, accurately, and efficiently.